Many Israeli concerns have been unsuccessful achieving the success that Teva has accomplished, because of the challenge in breaking into the innovation sector, the inability to raise proper funding for expansion, and the lack of experience in taking drugs through the regulatory process & to market.

By Reuters

As Israel’s biggest company Teva strives to get even bigger by swallowing up rival Mylan for more than $40 billion, further down the food chain a raft of upstart life science firms are struggling to climb onto the global ladder.

Photo: EPA

Now the government is starting to take notice, urged on by influential advocates, including Teva Pharmaceutical Industries’ own boss, who says the country’s economic future depends on replicating his company’s success.

Israel has a burgeoning life science industry comprising around 1,380 mostly very small companies. Some 51 biotech, biopharma and medical devices firm are listed on the Tel Aviv Stock Exchange, making it the largest single sector.

But few of them go on to build up their businesses, with most promising ideas snapped up by foreign heavyweights.

Novartis, Johnson & Johnson and Merck Serono have all opened research centres in Israel, usually by acquiring small companies. Merck Serono’s best-selling drug, Rebif, which treats multiple sclerosis (MS), was developed in Israel.

That frustrates many in the Israeli industry, who believe the country is letting wealth and expertise drain overseas.

“Start-up nation is not a sustainable model for Israel. What Israel needs is more large companies,” Teva CEO Erez Vigodman said at the launch of a joint venture with Philips to invest in Israeli medical device and digital health start-ups.

Teva, the world’s largest generic drugmaker with annual sales of $20 billion, used its fortune from copycat drugs to move into the costlier innovative sector. Today, around half its profit is from one branded drug, MS treatment Copaxone.

That is not an easy model to replicate.

The biggest problem for Israeli firms, according to Claudio Yarza, head of life sciences at consultants PricewaterhouseCoopers (PwC) Israel, is a lack of funding — from university level to capital markets,

There are some signs, however, that is starting to change.

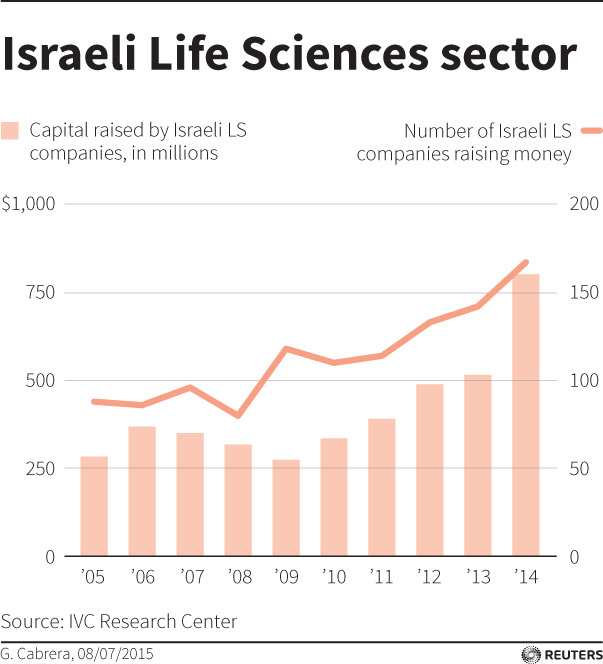

Israeli life science firms raised more than $2 billion from various resources in 2014, a record year, according to the Israel Advanced Technology Industries (IATI) association.

What’s more, start-ups raised $801 million, according to the Israel Venture Capital Research Center, up 55 percent on 2013.

That’s almost twice the rate of growth in the United States, although start-ups there raised a much larger $8.6 billion, according to PwC and the National Venture Capital Association.

Also, of 73 biotech companies that went public on Nasdaq last year, seven were Israeli.

“Maybe now that some companies have raised nice sums on Nasdaq they will be able to take their drugs all the way,” said PwC Israel’s Yarza.

Government Action

Israeli firms also complain about red tape, and the lack of manufacturing in Israel which means they have to turn to foreign companies for help developing drugs.

“We don’t have enough drug development and manufacturing experience and infrastructure in Israel,” Compugen CEO Anat Cohen-Dayag told Reuters.

Compugen, which discovers drugs mainly in cancer immunotherapy using computational technology, has partnerships with Merck Serono and Bayer.

However, the Israeli government is now helping firms set up their own plants by offering funds for equipment, according to Ora Dar, head of life sciences in the chief scientist’s office.

In addition, “we are talking to CMOs (contract manufacturing organisations) to see what it will take to convince them to build facilities in Israel,” she said.

Dar said the government was tackling another common complaint among life science executives — a lack of experience in taking drugs through the regulatory process to market.

The government is increasing funding for the health regulator to help speed approval for clinical trials in Israel, she said.

There’s a long way to go.

While individual Israeli companies such as Protalix, whose plant-based enzyme was approved to treat Gaucher disease, may succeed, “most will either license their products to larger corporations or be acquired,” said IATI co-chairman Benny Zeevi.

But Compugen’s Cohen-Dayag was cautiously optimistic.

“A small company that would like to take drugs to the market cannot establish the infrastructure in Israel on its own,” she said. “I think the government recognises this now and is trying to build bridges to address these gaps, but it will take time.”

View original Ynet publication at: http://www.ynetnews.com/articles/0,7340,L-4677845,00.html

Israeli New Shekel Exchange Rate

Israeli New Shekel Exchange Rate